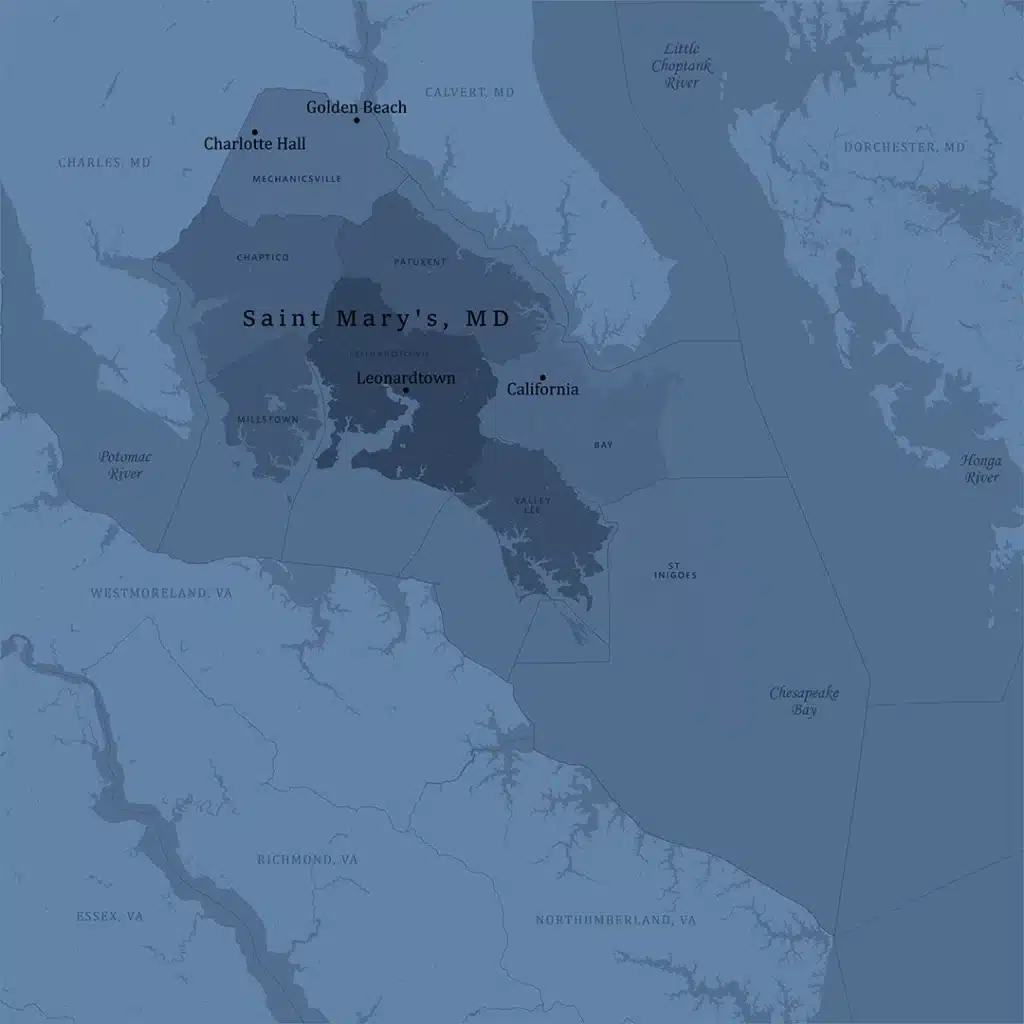

St. Mary’s County Residents:

KNOW THE FACTS ABOUT TAXES ON REAL ESTATE

Tax Increases Hurt

St. Mary's County Residents

Tell Your Commissioner to Oppose Tax Increases They Said Wouldn’t Happen

What will this mean for local residents?

The reality is that development excise taxes end up robbing homeowners of equity, discouraging home ownership, and hindering economic growth, as these costs are generally transferred to buyers.

Public facilities and infrastructure like schools, water and sewer, and transportation should be funded by local county governments from their existing property tax and income tax bases to keep up with population growth.

Now, more than ever, citizens are burdened with inflation and high costs of living, making a tax increase especially painful. Join us in our efforts to prevent these tax increases and promote sustainable economic growth in St. Mary’s County.

Take Action Today

Contact your county commissioners to let them know that you oppose this tax increase and to encourage them to remain revenue neutral. Together, we can ensure that our community remains a great place to live, work, and raise a family.

Our Upcoming Public Hearings

4/18 at 6:30 at the Commissioner’s Meeting Room in Leonardtown

4/25 at 6:30 at the Chopticon High School